Investing is about value, buying low and selling high. But how do you determine value if the most popular value gauge has been compromised. Yes, via a 2008 economic stabilization act, Congress changed the ‘E’ of P/E.

In 2008 everyone (aside from short-sellers) were in crisis mode. Banks, Federal Reserve, Treasury Secretary and the President were ready to do whatever it takes to get the job done.

The job? Bail out banks and push the S&P 500 higher (SNP: ^GSPC). How? Didn’t matter.

The job got done, and with stocks as with sausages, if the end result tastes good you don’t ask how they’re made.

Not a day goes by where we don’t read about bank profits, bank bonuses, and bank shenanigans to make more profit. So let’s talk about bank profits for a moment.

Not everything that shines is gold and not everything that’s black on the income statement is profit.

From Mark-to-Market to Mark-to-Make-Believe

There was a time when banks loved the Mark-to-Market accounting model, because it allowed them to showcase truly miraculous real time profits. By 2006/07 the financial sector accounted for over 40% of S&P 500 earnings.

Things changed in 2007/08. Mark-to market wasn’t so popular with banks because it revealed enormous real time losses. Bankers don’t like to see red. Bankers prefer to hide their losses.

The Federal Reserve and Congress decided that’s a good idea since losses erode confidence.

Bankers lobbied the Financial Accounting Standards Board (FASB) to change the fair market accounting rule – rule 157 – but the FASB resisted. The FASB knew that changing fair market or Mark-to-Market was a free pass that practically required no write-downs ever.

However, via the Emergency Economy Stabilization Act of 2008, Congress gave the SEC the authority to suspend Mark-to Market accounting. FASB was strong-armed and FASB rule 157 was suspended on April 2, 2009.

FASB 157 – What Does it Mean?

Since April 2, 2009, banks are basically free to value their toxic assets as they please. This example illustrates how the financial engineering formula works in real life.

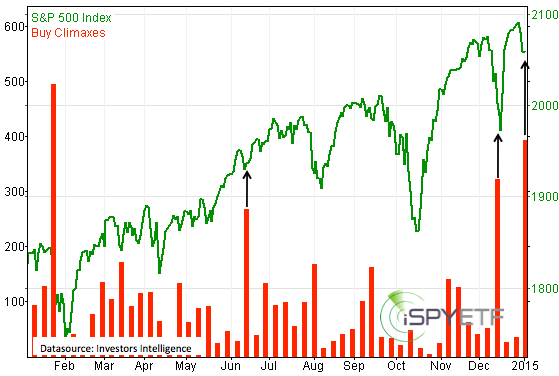

The two charts below show 1) S&P 500 P/E ratio and EPS (based on as reported data) 2) S&P 500 financial sector EPS (datasource: Standard & Poor’s).

Bank ABC holds mortgage-backed assets originally valued at $1,000. After running some proprietary and non-verifiable models the bank determines it will eventually sell the asset for $950. The loss, termed credit loss, is only $50.

However, because of MBS bad rep, the banks portfolio is currently worth only $500. The actual current value ($500) minus the credit loss ($50) is called noncredit loss ($450).

The $450 noncredit loss is recorded on the balance sheet under “comprehensive income,” but is not run through the income statement. Those losses don’t affect earnings, and are excluded from banks’ regulatory capital calculation.

That’s right, every single bank earnings report since April 2, 2009 did not account for losses from toxic assets.

This means that the P/E ratio for ETFs like the Financial Select Sector SPDR (NYSEArca: XLF) and by extension the SPDR S&P 500 ETF (NYSEArca: SPY) is skewed.

It’s been nearly four years since the FASB rule 157 change, so why write about it now?

Because the European Commission is proposing a similar accounting change, and (this is a real shocker) confiscation of private assets to help banks. More details here: Europe Proposes Mass Confiscation of Private Assets

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.